While the market has been increasingly focused on the rising headwinds in the global economy in general, and China's economic slowdown in particular, while the media is obsessing over daily revelations that Trump may or may not have colluded with Russia to get elected, a far more critical, if underreported, shift has been taking place over the past year.

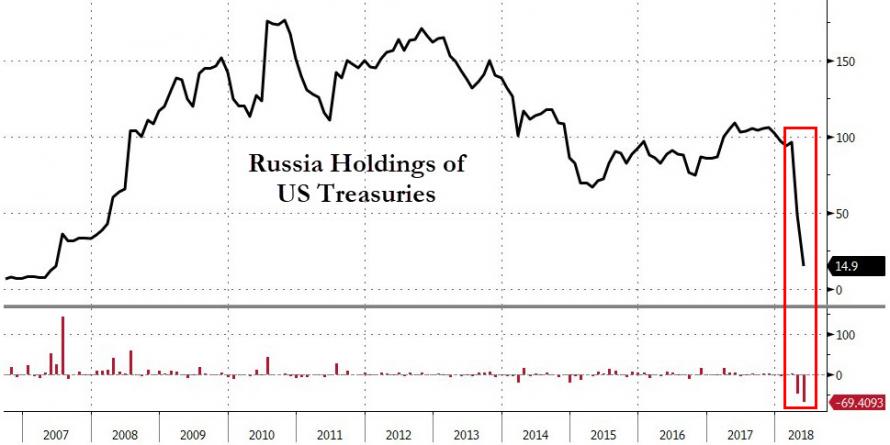

As we reported in June, whether due to concerns over draconian western sanctions and asset confiscations following the poisoning of former Russian military officer Sergei Skripal, or simply because it wanted to diversify away from the dollar, Russia liquidated virtually all of its Treasury holdings in the late spring and early summer, in the process sparking a major repricing of the 10Y US Treasury, whose yield jumped from 2.70% at the start of April to a high of 3.10% in May, a move which economists were struggling to explain at the time.

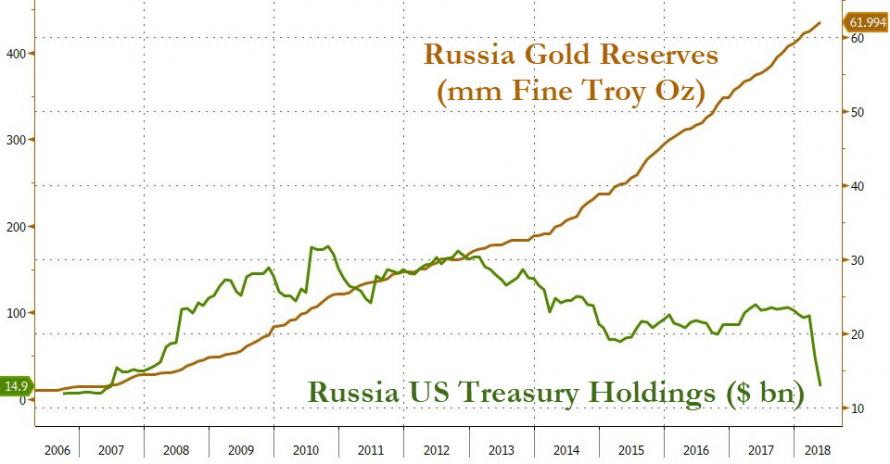

The obvious next question is what did Russia do with the proceeds, and it came as little surprise that, as we wrote back in July, as Russia was selling nearly $100BN worth of Treasurys, it was aggressively buying gold.

In addition to gold, the Kremlin also instructed the Russian finance ministry to load up on Yuan, something which we noted at the end of September, when we showed the surge in reserves allocated to the Chinese Yuan.

As part of its reallocation away from the dollar, Russia also bought a substantial amount of other non-USD currencies, and according to a recent report, the money pulled from the dollar reserves was redistributed to increase the share of the euro to 32%, the yuan to 14.7%, and another 14.7% of the portfolio was invested in other currencies, including the British pound (6.3%), Japanese yen (4.5%), as well as Canadian (2.3%) and Australian (1%) dollars.

And now, the final missing piece of Russia's massive capital reallocation out of the petrodollars has emerged, after the Telegraph reported that Moscow is preparing an investment in Bitcoin in a bid to tackle US sanctions, according to a Russian economist with close ties to the Kremlin.

According to Vladislav Ginko, an economist at the state-funded Russian Presidential Academy of National Economy and Public Administration, the government is taking steps to minimize the impact of US sanctions that have hit the Russian rouble by replacing some of its US dollar reserves with the world’s most popular cryptocurrency.

Quoted by The Telegraph, Ginko said he believes Russia’s de-dollarization decision is fundamentally a move to "protect its national interests" due to a possible interruption of “US nominated payments flows for Russian oil and gas” and claims that the investment in bitcoin could be as much as $10bn (£7.8bn); a material enough amount to send the price of bitcoin sharply higher.

When would Russia's next capital reallocation take place? According to the Russian economist, the purchases could start as soon as next month. Cryptocurrencies have seen a surge of interest in Russia, where President Putin has expressed an interest in the digital assets in recent months. Ginko believes Bitcoin and the wider cryptocurrency industry now account for 8% of Russia’s GDP, and investment to bolster the country’s reserves with Bitcoin could start as soon as February.

“[The] Russian government is about to make a step to start diversifying financial reserves into Bitcoin since Russia [is] forced by US sanctions to dump US Treasury bonds and [take] back US dollars,” Ginko said.

No comments:

Post a Comment