Headlines from the past three-days:

Dow sinks 2,000 points in worst day since 2008, S&P 500 drops more than 7%

Dow rallies more than 1,100 points in a wild session, halves losses from Monday’s sell-off

Dow drops 1,400 points and tumbles into a bear market, down 20% from last month’s record close

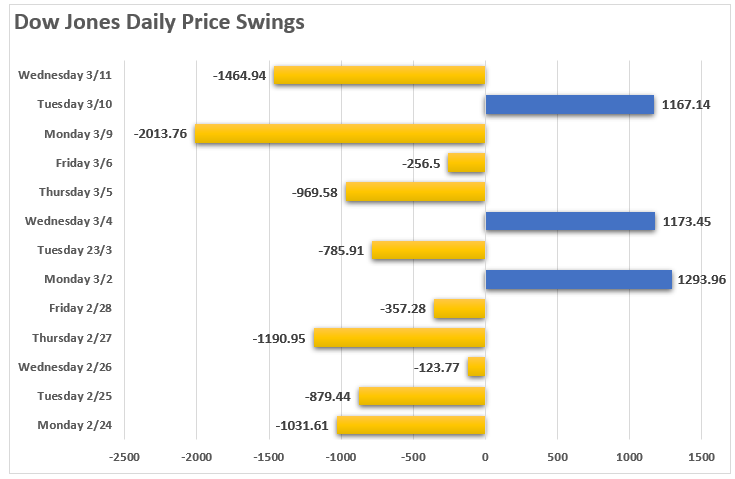

It has, been a heck of a couple of weeks for the market with daily point swings running 1000, or more, points in either direction.

However, given Tuesday’s huge rally, it seemed as if the market’s recent rout might be over with the bulls set to take charge? Unfortunately, as with the two-previous 1000+ point rallies, the bulls couldn’t maintain their stand.

But with the markets having now triggered a 20% decline, ending the “bull market,” according to the media, is all “hope” now lost? Is the market now like an “Oriental Rug Factory” where “Everything Must Go?”

It certainly feels that way at the moment.

“Virus fears” have run amok with major sporting events playing to empty crowds, the Houston Live Stock Show & Rodeo was canceled, along with Coachella, and numerous conferences and conventions from Las Vegas to New York. If that wasn’t bad enough, Saudi Arabia thought they would start an “oil price” war just to make things interesting.

What is happening now, and what we have warned about for some time, is that markets needed to reprice valuations for a reduction in economic growth and earnings.

It has just been a much quicker, and brutal, event than even we anticipated.

The questions to answer now are:

- Are we going to get a bounce to sell into?

- Is the bear market officially started – from a change in trend basis; and,

- Just how bad could this get?

On a weekly basis, the rising trend from the 2016 lows is clear. The market has NOW VIOLATED that trend, which suggests a “bear market” has indeed started. This means investors should consider maintaining increased cash allocations in portfolios currently. With the two longer-term sell signals, bottom panels, now triggered, it suggests that whatever rally may ensue short-term will likely most likely fail. (Also a classic sign of a bear market.)

No comments:

Post a Comment