Everybody is trampling all over themselves to raise bullish targets. $SPX 3,300, $SPX 3,350, $SPX 3500, do I hear Dow 31,500? Yes I am. The big driver of course the Fed and central banks cutting rates again to save the global economy.

But I have a question:

Why does the global economy need rescuing after 10 years of non stop monetary stimulus?— Sven Henrich (@NorthmanTrader) July 16, 2019

I also have an answer and it’s an unpleasant one. Because by bailing out markets and economies at every sign of trouble over the past 10 years central banks have given politicians license to do nothing. And nothing is what you get as political discourse fragments and majority solutions are impossible to come by.

But not only are majority solution impossible to get nobody even wants to even talk about them. Why? Because they involve pain. Voters don’t want to hear pain. Hence all you hear is free money. Tax cuts in 2016. Now we hear free college, health care and debt forgiveness for 2020 and who knows maybe more tax cuts.

Nobody wants to campaign on pain. I get it. But does anyone really think solving the structural problems that are behind slowing growth after 10 years of monetary stimulus are easily solvable?

Heck, they may not be solvable at all, hence it’s easier to create a political climate of hate, division, distraction and outrage.

Everybody talks about the outrage of the day, it’s a hyped up atmosphere by design. Because the architects of the conversation know the truth, and that is: As long as people are distracted by outrage, fear, anger and emotion they will not think about how the system is actually utterly screwed.

Debt ceiling? Nobody takes it seriously and the supposed enemies labeling each other currently as racists and socialists will suddenly find a solution and compromise to raise the debt ceiling. They always do. It’s always drama, and talk and hand wringing, but it never means anything.

Remember fiscal conservatives? They only exist when they are not in power. Nobody really wants to do anything but offer free money in one form or another. On either side.

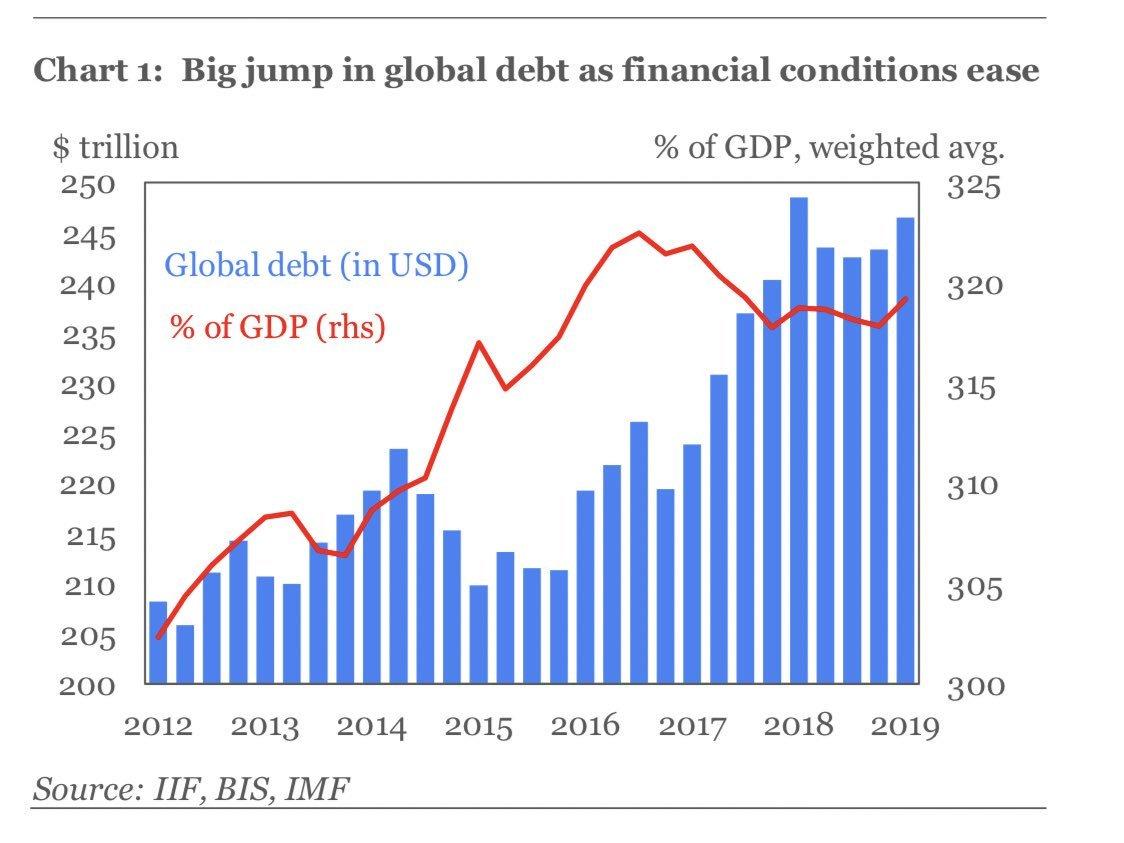

In debt we trust:

But apparently central bankers are getting a sense that they can’t do it alone, that they need help from the politicians:

Central Bankers Are Sick of Rescuing the World Economy Alone“Global central bankers are again in the driving seat when it comes to propping up the world economy, but many are demanding governments join them in the rescue effort.Amid slowing global growth, the Federal Reserve, European Central Bank and perhaps even the Bank of Japan are all set to ease monetary policy in coming months. But with less room to act than in the past, their leaders are telling politicians they will need to act if a downturn takes hold”.

Be clear their solution is to add more debt. That’s it. Stimulus. Because without stimulus nothing works.

Nobody is talking about structural solutions. Not the politicians, not the voters, not the central banks.

You know when structural solutions will be discussed? When it’s too late.

When the next crisis, crash, depression, whatever you want to call it, will force people to wake up and force them to come together and actually look at the problems. This will not happen now, not with this lot, and not with markets high, unemployment low, and central banks ready to throw free money around again.

No, central banks are now the impediment to progress, they are not only bailing out markets, but they are extending a license to politicians, a license to do nothing, but add more debt.

And that is the rise of insanity.

No comments:

Post a Comment