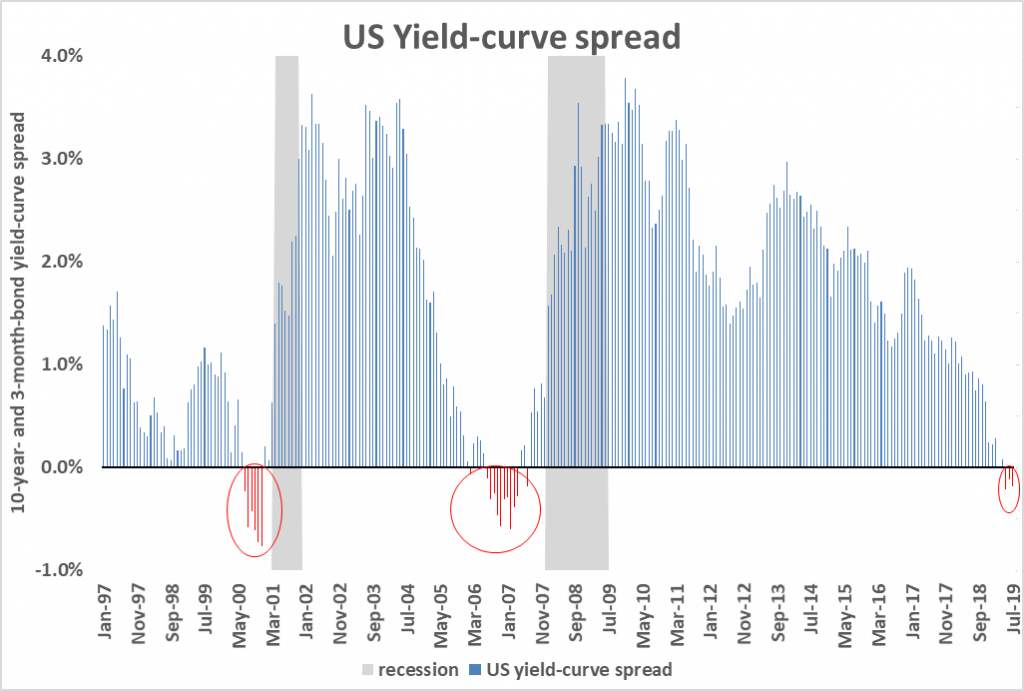

The yield curve spread is one of the most reliable leading indicators. One of the researchers who has written the most about the predictive power of the yield curve, Estrella (1998), suggests that the most reliable spreads is the yield of the ten-year sovereign bond (capital-market title) minus the yield on the three-month bond (money market title).

In the US, every time the spread has been close to zero or negative, a crisis has come within the next twenty-four months. In the following figure we can see the current spread along with those in the last two crises.

If the data from the most recent recessions are extrapolated using this indicator alone, we can anticipate that the next crisis in the US will occur in no less than six months and no more than twenty. That is to say, a crisis will take place sometime between January 2020 and March 2021.

The indicators shown here are some of the leading business cycle indicators we consider to be most accurate. Many other indicators can of course be included in an analysis of this kind, such as credit dynamics, the amount of currency in circulation, corporate risk spreads, and the demand for cyclical goods.

The indicators included here show weakness in the global economy. They indicate a possible crisis and recession in the US economy and perhaps in Europe as well. The crisis and recession do not appear to be imminent, but they are near. The yield curves indicate that the US recession could take place no less than six months and no more than twenty-four months from now. The world PMIs indicate a clear slowdown in global growth. They are close to recession levels, although they are still in neutral territory. However, the TED spread, which measures stress in the financial sector, is not showing any problems. Finally, the Fed is anticipating problems, as witness its announcement of possible cuts to the interest rate.

If our thesis holds true, there is still some time for economic agents to prepare themselves for an economic future with more shadow than light.

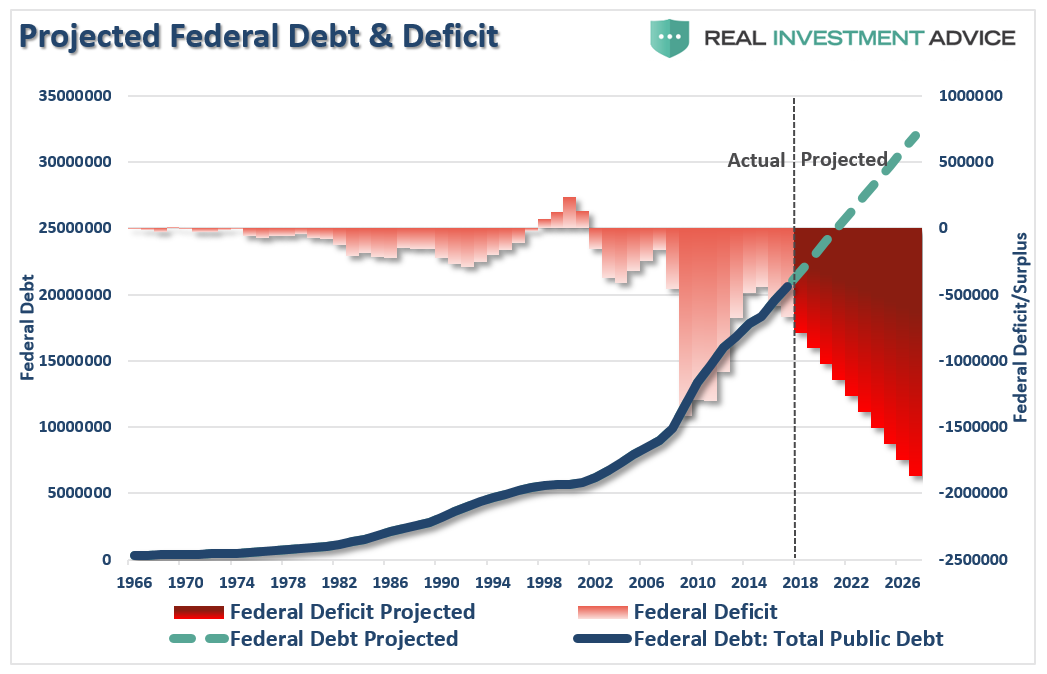

“In 2018, the Federal Government spent $4.48 Trillion, which was equivalent to 22% of the nation’s entire nominal GDP. Of that total spending, ONLY $3.5 Trillion was financed by Federal revenues, and $986 billion was financed through debt.

In other words, if 75% of all expenditures is social welfare and interest on the debt, those payments required $3.36 Trillion of the $3.5 Trillion (or 96%) of revenue coming in.”

Do some math here.

The U.S. spent $986 billion more than it received in revenue in 2018, which is the overall ‘deficit.’ If you just add the $320 billion to that number you are now running a $1.3 Trillion deficit.

The U.S. will not default on its debt.

This is particularly the case since we no longer have any budgetary controls.

Importantly, the spending increase of $320 billion is on top of the annual 8% automated budget increase and the preexisting deficit. My original projection above is too conservative by $500 billion, or more.

But that’s not the real story.

The crux of that article was focused on the roughly $6 Trillion of unfunded liabilities of U.S. pension funds which Congress is now drafting a piece of legislation for entitled the “Rehabilitation For Multi-employer Pensions Act.”

As noted in that article, while Congress is preparing a bailout for U.S. pension funds, there is a $70 Trillion pension problem globally which is not being addressed.

“America’s debt load is about to hit a record. The combination of cheap money and soaring debt helped fuel the decade-long economic expansion and bull market, but America’s gluttony of loans could work against it if its fragile economic balance shifts.

In the first quarter of 2019, the United States’ total public- and private-sector debt amounted to nearly $70 trillion, according to research by the Institute of International Finance. Federal government debt and liabilities of private corporations excluding banks both hit new highs.”

As I noted this past week, the real crisis comes when there is a “run on pensions.” With a large number of pensioners already eligible for their pension, and a near $6 trillion dollar funding gap, the next decline in the markets will likely spur the “fear” that benefits will be lost entirely.

The combined run on the system, which is grossly underfunded, at a time when asset prices are dropping, credit is collapsing, and shadow-banking freezes, the ensuing debacle will make 2008 look like mild recession.

It is unlikely Central Banks are prepared for, or have the monetary capacity, to substantially deal with the fallout.

As David Rosenberg previously noted:

“There is no way you ever emerge from eight years of free money without a debt bubble. If it’s not a LatAm cycle, then it’s energy the next, commercial real estate after that, a tech mania years after, and then the mother of all of them, housing over a decade ago. This time there is a huge bubble on corporate balance sheets and a price will be paid. It’s just a matter of when, not if.”

Never before in human history have we seen so much debt. Government debt, corporate debt, shadow-banking debt, and consumer debt are all at record levels. Not just in the U.S., but all over the world.

If you are thinking this is a “Goldilocks economy,” “there is no recession in sight,” “Central Banks have this under control,” and that “I am just being bearish,” you would be right.

But that is also what everyone thought in 2007.

No comments:

Post a Comment