Michael Every

Enough minutiae about Fed policy: our house view remains they are going all the way back to zero. Enough minutiae about PMIs: it is obvious that broad swathes of the economy are slowing down.

The global backdrop remains of slowing growth, increased financial vulnerability in places, and yet an institutional architecture that is either in denial or has no firm idea of what policy mix to use to stop this happening. And, crucially, global populations that are not content to just sit and wait for something better to turn up eventually.

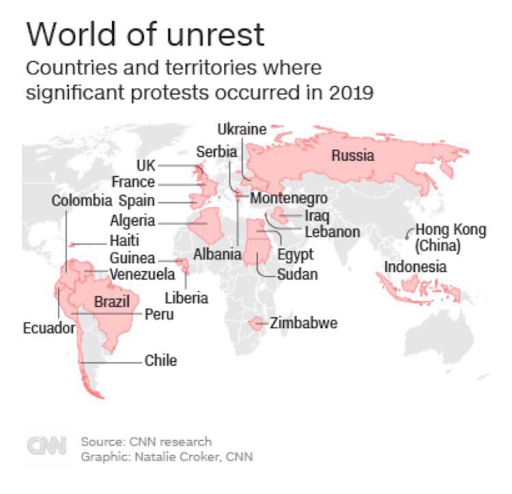

Indeed, consider that we now have mass public unrest (on and off) in: France, Spain, and that 24% AfD vote in Germany, and Brexit in the UK; Algeria; Iraq: Lebanon; Egypt; Russia; Hong Kong; Venezuela; Chile; Ecuador; and Bolivia. Plus deepening polarisation in the US – and one could add the middle-class disruption of Extinction Rebellion in Australia, Canada, and others.

In short, there isn’t a continent that isn’t seeing unrest in some form, and as Branko Milanovic notes today, one wonders if this isn’t all a little 1968-ish.

When you look at Chile, Ecuador, Venezuela, Bolivia, Hong Kong, Spain, France, Algeria, Iraq, Lebanon, Egypt, Russia...you sort of wonder if 2019-20 will be a new (global) 1968.— Branko Milanovic (@BrankoMilan) October 27, 2019

Of course, one can’t usually join dots that simply, but if this is 1968-redux then consider the historical echoes. The Prague Spring was violently crushed by Soviet Tanks and the West was powerless to prevent it. Meanwhile, student uprisings in the West produced social reforms and a policy swing to the Left. Along with the Vietnam War, that contributed to the end of the USD peg to gold and the first phase of the global Bretton Woods order – and then to very high inflation in the 1970s, which was ultimately ended by the Volcker Fed and the current phase of deflationary neoliberal globalisation that is once again pushing people out onto the streets.

In short, regardless of what the Fed does this week, or the BOJ; and whatever the PMIs print at; and whatever the EU or Boris give and get, we still face Ages and Ages of Rage in a market that is still largely pricing for the calm of the status quo ante.

No comments:

Post a Comment