Truth In Accounting (TIA), a 501(c)(3) - focused on government financial information, published a new report that suggests the federal government's overall financial conditions worsened by $4.5 trillion in 2018. The report also calculates the actual national debt on a per taxpayer basis.

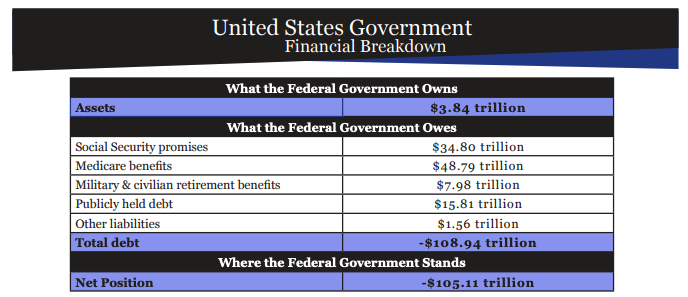

With assets of $3.84 trillion, the federal government’s unfunded obligations and debt total $108.94 trillion, which contributed to a $105 trillion debt burden.

"Our elected officials have made repeated financial decisions that have left the federal government with a debt burden of $105 trillion, including unfunded Social Security and Medicare promises. That equates to a $696,000 burden for every federal taxpayer," TIA states.

TIA rated the federal federal government with an "F" for its financial outlook and worsening fiscal situation that could trigger a crisis in the not too distant future.

TIA explains that while the $779 billion national deficit is troubling, it doesn’t reflect the true financial situation.

"The overall decline in Net Position presents a better picture of the government’s financial decline," the report states.

"The federal government's financial position continued to deteriorate – and much faster than indicated by the government's own ‘bottom-line,’" TIA’s Director of Research, Bill Bergman, said.

TIA pulled data from the "Financial Report of the U.S. Government" for the fiscal year ending Sept. 2018.

TIA's "bottom line" measures the government's unfunded debt, jumped by $4 trillion in 2018, about 4 times faster than the budget deficit or net operating cost.

Interest expenses on the national debt have been one of the fastest growing expenses, "while the government's estimate of the fiscal gap - the amount of spending cuts and/or tax increases necessary to keep the debt/Gross Domestic Product ratio from rising in the future – doubled," TIA reports.

"Perhaps the most alarming feature of the government's release of its annual financial report was the public reaction: deafening silence; zero coverage in the mainstream media," Bergman added.

TIA said the $1.5 trillion in students loans was the fastest growing asset on the federal balance sheet.

Bergman said that the Treasury Department doesn't include unfunded Social Security and Medicare liabilities on the federal balance sheet, these debts are included in TIA’s report.

The federal government’s assets stand at $3.84 trillion, TIA notes. Income is derived from corporate taxes (6%), excise, estate, gift taxes and other revenue (11.5%), and individual income tax and withholding taxes (82.5%).

The combined unfunded liabilities of the federal government is $108.94 trillion. The government owes $34.80 trillion in Social Security benefits, $48.79 in Medicare benefits, $7.89 trillion in military benefits, $15.81 trillion in publicly held debt, and $1.56 trillion in other liabilities.

No comments:

Post a Comment