The price of this "solution"--the undermining of the financial system--will eventually be paid in full.

The financial storm clouds are gathering, and no, I'm not talking about impeachment or the Fed and repo troubles--I'm talking about much more serious structural issues, issues that cannot possibly be fixed within the existing financial system.

Yes, I'm talking about the cost structure of our society: earned income has stagnated while costs have soared, and households have filled the widening gap with debt they cannot afford to service once the long-delayed recession grabs the economy by the throat.

Everywhere we look, we find households, enterprises and local governments barely able to keep their heads above water--in the longest expansion in recent history. This is as good as it gets, and we're only able to pay our bills by borrowing more, draining rainy-day funds or playing accounting tricks.

So what happens when earned income and tax revenues sag? Households, enterprises and local governments will be unable to pay their bills, and borrowing more will become difficult as the financial markets awaken to the re-emergence of risk: as shocking as it may be in the era of Central Bank Omnipotence, borrowers can still default and lenders can be destroyed by the resulting losses.

The era of Central Bank Omnipotence has been characterized by two things:

1. A disconnect between risk and return. Since "central banks have our backs," risk has been vanquished, and since central banks socialize losses by bailing out corporations and banks who gambled and lost, then the financial Oligarchs have been free to ignore risk since the Federal Reserve has implicitly guaranteed returns will always be secured by Fed backstops, market interventions, etc.

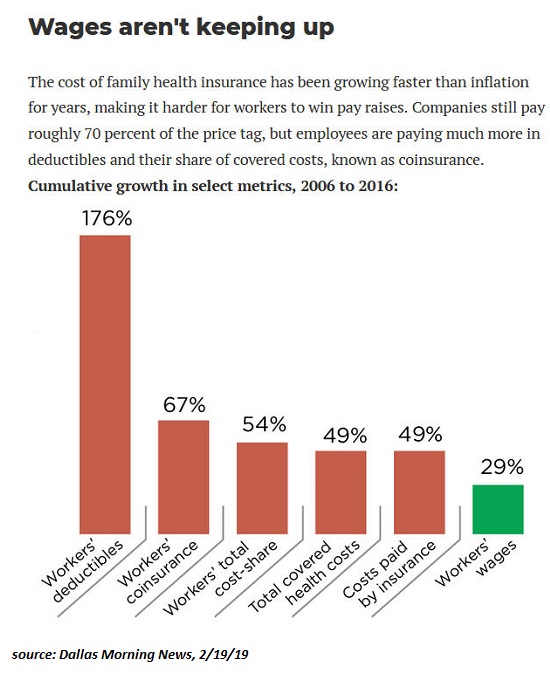

2. Costs have been ignored because "we're all getting richer" via asset bubbles. Your healthcare insurance just doubled in a couple of years? Forget it, Pal, that's chump change compared to the big-time gains in the value of your house and 401K stock holdings. This is the wealth effect: even as rising costs consume earned income, we ignore this financial erosion and borrow and spend more because we feel richer when we look at our home and stock valuations.

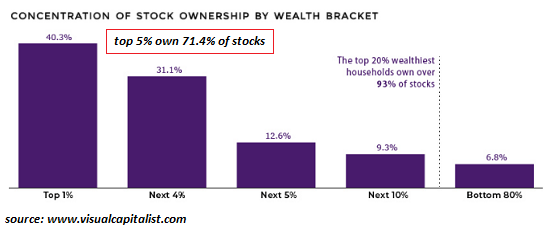

In other words, the wealth effect has been deployed to paper over the enormous structural gap between income and expenses. The wealth effect doesn't just affect households: rising real estate valuations have boosted local government tax revenues, and small businesses have been buoyed by the spending of the top 20% who own 93% of the stocks owned by households and who have seen their homes soar in value. (Note that the top 5% own 71% of the stocks; the top 10% own 84%.)

But asset bubbles always pop, and once they do, the wealth effect reversesand people feel poorer as the value of their homes and portfolios decline. They borrow and spend less, and all the capital gains that boosted local tax revenues dry up, too.

Here's reality: wages haven't kept up with expenses. This chart displays healthcare costs, but rent, higher education, childcare, etc. have similar asymmetries.

Not to pick on these households, but they are representative of the enormous asymmetry between stagnant income and rising costs, and of the "solution": debt, and lots of it.

I was surprised to find such an honest account in the mainstream (i.e. cheerleader of "good news") Wall Street Journal:

Families Go Deep in Debt to Stay in the Middle Class

Wages stalled but costs haven’t, so people increasingly rent or finance what their parents might have owned outright Median household income in the U.S. was $61,372 at the end of 2017, according to the Census Bureau. When inflation is taken into account, that is just above the 1999 level. How households earning $61,000 can acquire cars costing half their gross income is a story of the financialization of the economy.

Wages stalled but costs haven’t, so people increasingly rent or finance what their parents might have owned outright Median household income in the U.S. was $61,372 at the end of 2017, according to the Census Bureau. When inflation is taken into account, that is just above the 1999 level. How households earning $61,000 can acquire cars costing half their gross income is a story of the financialization of the economy.

More accurately: financialization is the result of the cost structure pulling away from our ability to pay our expenses with earned income. The only way to enable costs to continue soaring far above our ability to pay them is to financialize the economy, making debt the core mechanism to pay the bills, and asset bubbles the core mechanism to create phantom collateral to support the skyrocketing debt.

Here's the problem with reducing the cost structure to levels we can actually afford: all the fat in our system is screaming that it's bone. The slightest reductions trigger titanic lobbying by whatever group of insiders or vested interests will bear the brunt of the cuts.

This leaves politicians with one easy way out: borrow enough money to satisfy the demands of every constituency, every clique of insiders and every vested interest. Rather than re-aligning costs with our ability to pay, we're going to use debt to keep all the constituencies happy.

The price of this "solution"--the undermining of the financial system--will eventually be paid in full to the detriment of everyone, including all the layers of productivity-killing fat that proclaimed themselves essential bone.

No comments:

Post a Comment