Macroeconomic analyst Rob Kirby says the big elephant in the global financial room, that nobody wants to acknowledge, is the still “missing” $21 trillion from the DOD and HUD. Kirby contends, “They don’t want to believe it. They don’t want to believe that, at least, $21 trillion in extra dollars has been created out of thin air. It is siloed, and I would say it is siloed in dark places like the Exchange Stabilization Fund (ESF), which is the secretive adjunct to the U.S. Treasury. I would also contend that this enormous cache of dark money is exactly what is used to do dirty tricks like rig the precious metals market because that is a very expensive operation to carry out. That is not a sustainable sort of thing. The Fed . . . knew years and years ago that they were going to hit a point where the amount of money that they would need to be put into the system would have to grow vertically. This is why they created and siloed at least $21 trillion extra dollars.”

Kirby also says the extra $21 trillion “missing” dollars has been a well-kept secret. Kirby says, “This is a true secret, and I am going to say a true secret of the Deep State. This is why everybody avoids this at all costs.”

What is the downside to massive money printing? Kirby says, “Is everything going to be okay in America when people really realize how much money there really is in existence. When people realize instead of money supply being “X,” and it’s really 10 times “X,” is everything going to be okay then? I don’t think so. Once there is widespread acceptance that the money supply is not “X,” but it is 10 times “X,” 10 “X” is going to come home to America very quickly. That 10 “X” worth of money is going to be buying anything that isn’t nailed down things, and it might be buying things that are nailed down. We are going to get a hyperinflation. There is absolutely no doubt in my mind. It’s not a question of if, it’s only a question of when.”

Kirby, who is also a broker of physical precious metals by the ton for wealthy clients, says people are quietly panicking. Kirby explains, “If you look at a duck moving across the water, it looks very graceful. But if you take a picture of what’s going on underneath the waterline, you see the duck paddling seriously. In the precious metals space, what we see above the waterline is the reckless suppression of physical precious metals . . . but what’s really going on beneath the waterline is mega, mega money is on a ‘seek and acquire’ mission to secure physical precious metals in amounts that would stagger most people. . . . There will come a point where physical precious metal will be hard, if not impossible, to find in exchange for fiat currency. . . .The amount of money seeking physical precious metals would alarm a lot of people. You are talking stupid amounts of money.”

There is free information and analysis on KirbyAnalytics.com. To become a subscriber for $145 per year, click here. Rob Kirby’s latest article is called “Big Money and The Big Lie,” and he’s giving it to you below for free:

Big Money and the Big Lie

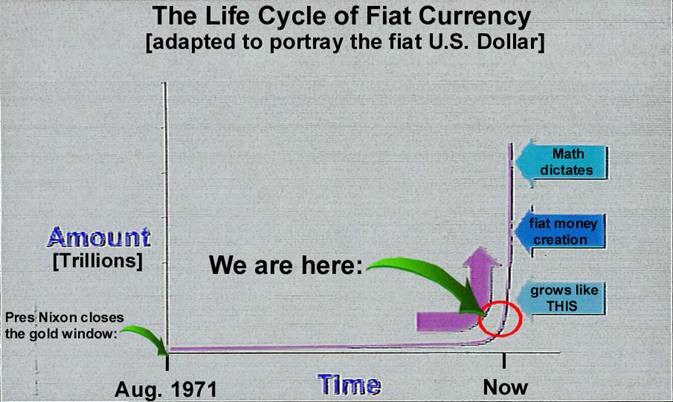

The picture below is one of the most important pieces anyone could look at to begin understanding the true nature/condition of our global financial system:

This picture depicts the life cycle of “ANY” fiat currency with compound interest. This concept is explained thoroughly by Chris Martenson on his web site under the moniker of The Accelerated Crash Course. I recommend everyone read it.

The important take-away from the picture above is that the US dollar is now on the vertical growth part of its “life curve”. Naysayers might argue, “money growth is not increasing at a vertical rate because the Fed stopped QE [Quantitative Easing] a number of years ago”.

Perhaps the Fed did “technically” stop QE a number of years ago, BUT, the folks at the Fed are well aware of the facts regarding the life cycle of fiat money depicted above. They know if the money is not created, the financial system [US Dollar] collapses onto itself. So what gives?

Connecting Dots

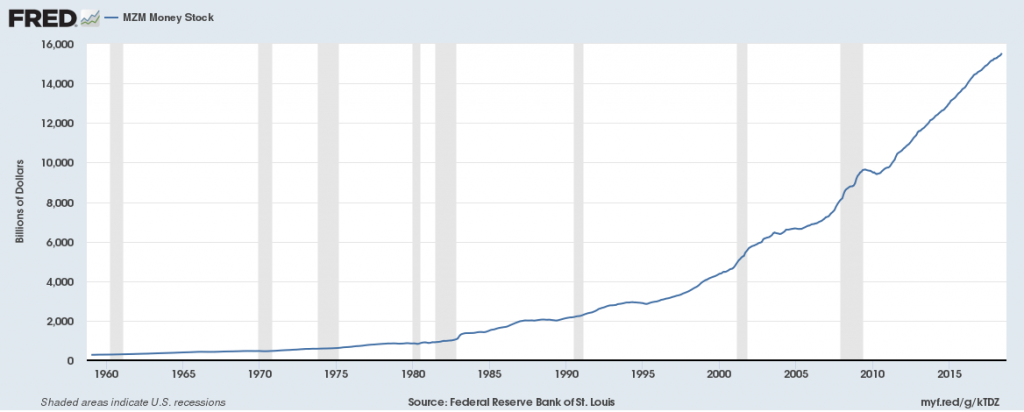

Instead of the vertical nature of the money growth chart above, the Fed would like us to believe that money growth is better reflected by their more sanguine “official” count depicted below:

The important take-away from the picture above is that the US dollar is now on the vertical growth part of its “life curve”. Naysayers might argue, “money growth is not increasing at a vertical rate because the Fed stopped QE [Quantitative Easing] a number of years ago”.

Perhaps the Fed did “technically” stop QE a number of years ago, BUT, the folks at the Fed are well aware of the facts regarding the life cycle of fiat money depicted above. They know if the money is not created, the financial system [US Dollar] collapses onto itself. So what gives?

Connecting Dots

Instead of the vertical nature of the money growth chart above, the Fed would like us to believe that money growth is better reflected by their more sanguine “official” count depicted below:

Do remember folks, the chart above reflect the “officially acknowledged money supply”. The growth rate does not appear to be vertical, does it?

But what about the fraudulently created, missing 21 TRILLION identified by Dr. Mark Skidmore [PhD. Michigan St.] and Catherine Austin Fitts [former undersecretary of HUD – Bush 1 Admin]? This money is not acknowledged to exist and IS NOT part of the official monetary aggregate data depicted above. If one was to “add” the missing 21 Trillion to the 16ish Trillion depicted above – the growth rate would INDEED BE VERTICAL.

So folks, while the Fed may be able to legally claim that QE ended years ago, the REQUIRED monies have been created and they have been silo-ed in places like the ESF [EXCHANGE STABILIZATION FUND].

“The U.S. Exchange Stabilization Fund was established at the Treasury Department by a provision in the Gold Reserve Act of January 31, 1934. 31 U.S.C. § 5117. It was intended as a response to Britain’s Exchange Equalisation Account.[2] The fund began operations in April 1934, financed by $2 billion of the $2.8 billion paper profit the government realized from raising the price of gold to $35 an ounce from $20.67. The act authorized the ESF to use its capital to deal in gold and foreign exchange to stabilize the exchange value of the dollar. The ESF as originally designed was part of the executive branch not subject to legislative oversight.”

The web page devoted to the ESF claims that it contains only roughly 100 billion US dollars but then again, it is NOT SUBJECT TO LEGISLATIVE OVERSIGHT, so who really knows? We also know that the ESF was created to protect the dollar.

We also know that 21 Trillion US dollars are unaccounted for.

We also know that money growth matter-of-factly is greater than what is reported – because it MUST BE. It is not a stretch to figure the existence of this “dark money” is the real reason why US Government Bond auctions have NEVER failed, despite the reluctance of America’s traditional financiers to purchase record amounts of additional US government debt.

So folks, while the Fed may be able to say they are not directly engaged in QE, the US Treasury [ESF] IS and has been for some time – because they MUST. Additionally, the Fed necessarily was complicit in assisting the ESF in creating the dark money.

So folks, while the Fed may be able to say they are not directly engaged in QE, the US Treasury [ESF] IS and has been for some time – because they MUST. Additionally, the Fed necessarily was complicit in assisting the ESF in creating the dark money.

This is why the Fed will never be audited and this is also why,

“In an apparent departure from ‘generally accepted accounting principles,’ federal agencies will be permitted to publish financial statements that are altered so as to protect information on classified spending from disclosure…

It’s all part of the BIG LIE, ladies and gentlemen.

No comments:

Post a Comment