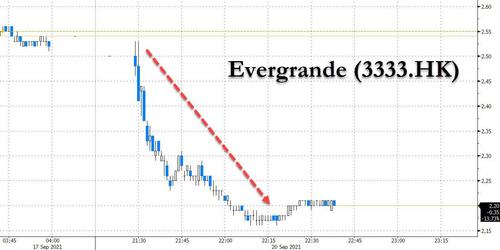

Well, as we warned, the Evergrande contagion has finally arrived and with China closed for holiday traders are getting out while they can and where they can, and on Monday morning in Asia that means Hong Kong, where Evergrande - which is about to default - has crashed by another 13% this morning and is on track to close at its lowest market cap ever (to be expected ahead of a bankruptcy that will wipe out the equity)...

... and with Evergrande property development peers such as New World Development & Sun Kung Kai Properties both down over 8%, and Sunac China and CK Asset plunging over 7%, the Hang Seng property index has crashed more than 6%, its biggest drop since 2020 to the lowest level since 2016...

And with traders on edge about the rapidly spreading contagion (as we described earlier) even sectors supposedly immune to China's property woes, such as the Hang Seng Tech Index are plunging, sliding as much as 2.7%.

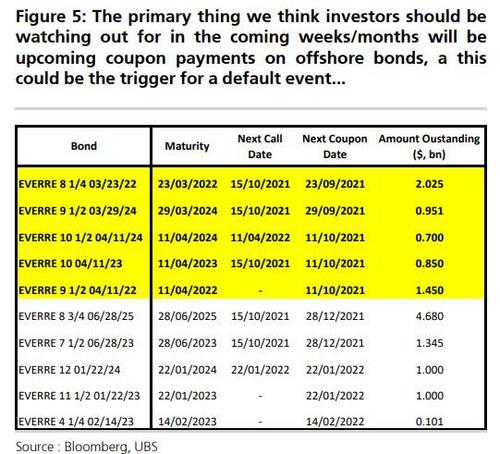

And speaking of Evergrande's imminent default, we noted earlier that while the company is scheduled to pay $83.5 million of interest on Sept. 23 for its offshore March 2022 bond, and then has another $47.5 million interest payment due on Sept. 29 for March 2024, the day of reckoning may come as soon as Tuesday: that's because Evergrande is scheduled to pay interest on bank loans Monday, with a one-day grace period. In other words, should it fail to arrange an extension, it could be in technical default as soon as Tuesday (for a much more detailed analysis of next steps please see "This Is How Contagion From Evergrande's Default Will Spread To The Rest Of The World".) Spoiler alert: a default is coming because Chinese authorities have already told major lenders not to expect repayment.

Other sectors are also getting hammered, such as Ping An Insurance, China’s largest insurer by market value, which plunged 7.3% in Hong Kong.

Meanwhile, pouring gasoline on the fire, Goldman's China anlyst Hui Shan published a note (available for professional subs in the usual place) on Sunday in which it discussed the rising risks from the property market, writing that even without the Evergrande debacle "housing activity fell sharply in July and weakened further in August" largely in response to China's structural reforms in the property sector (such as the "3 Red Lines"). At the same time, "concerns over Evergrande are rising and signs of financing difficulties spreading to other developers are emerging."

No comments:

Post a Comment