Charles Hugh Smith

Everyone expecting a quick resolution to the epidemic and a rapid return to pre-epidemic conditions would be well-served by looking beyond first-order effects.

So the media's focus is the first-order consequences: the number of infected people and fatalities, government responses such as quarantines, and so on. The general expectation is these first-order consequences will dissipate shortly and life will return to its pre-epidemic status with virtually no significant changes.

Second-order effects caution: not so fast. Second-order consequences may play out for months or even years even if the epidemic ends as quickly as the consensus expects.

The under-appreciated dynamic here is the tipping point, the imprecise point at which a decision to make fundamental changes tips from "maybe" to "yes."

The mistake made by those only considering first-order effects is that a modest effect "should" only generate modest consequences. For the observer focused solely on first-order effects, if the coronavirus epidemic blows over as expected, then supply chains "should" be unaffected because the effect is quantitatively modest.

But once we start considering cumulative second-order effects and potential tipping points, then the disruption of supply chains caused by the epidemic, no matter how modest, could be "the last straw" to those who had beneath the surface already shifted from "never leave China" to "maybe leave China." The epidemic could tip the decision process into "must leave China."

Consider two executives, one who looked at the longer term consequences of being dependent on production in China and began establishing alternative suppliers at the start of the trade war 18 months ago, and another exec who looked at the first-order hassles and expenses of moving out of China and stayed put to minimize short-term expenses.

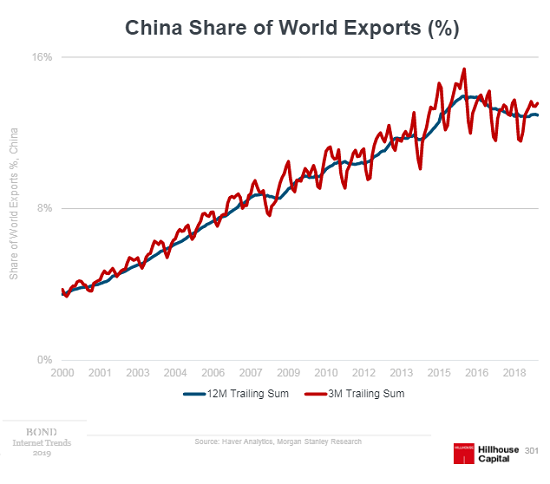

Individual decisions add up to trend changes, and these charts reflect a trend change in globalization and China's share of global exports. Globalization and China's share of global exports have both plateaued and are now entering the stagnation / decline phase of the S-Curve.

No comments:

Post a Comment