What is news is that Germany’s economy is in the toilet. Not slowing down…. not hitting some bumps.

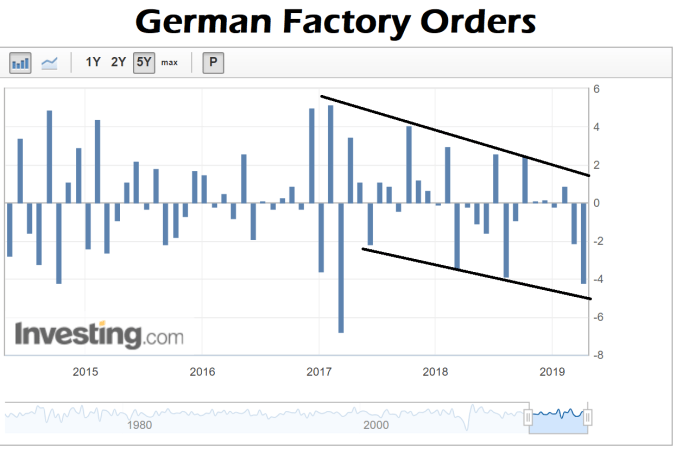

The Germans are industrial and exporting powerhouses. And the trends for those two things have been in decline for over a year.

Balance of trade for the past two quarters have been the lowest they’ve been since 2016. And the euro has backed off 13% since January of 2018. That’s because so much of Germany’s exports are to other EU countries and they are loaded to the gills with debt.

Furthermore, a big miss to the German Manufacturing Purchasing Managers Index (PMI) in March was confirmed this week by April’s number which was just as horrific. The March 22nd release missed by over 3 points to come in at 44.7 versus expectations of 48.0 (Anything under 50 is considered contraction). Contraction happened (again surprising the market) in February.

In fact, it’s been nothing but misses, some of them similarly horrible, since the beginning of last year.

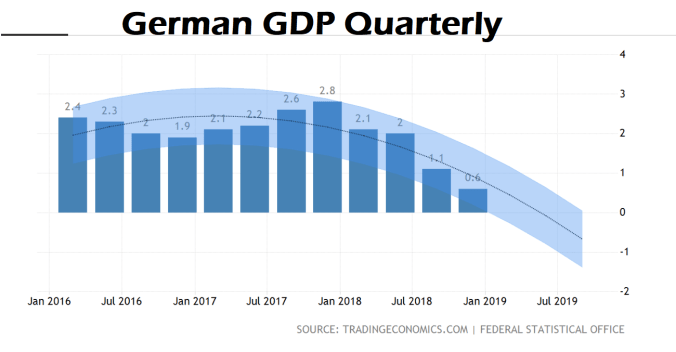

source: tradingeconomics.com

This is just the most dramatic of falling German economic indicators. But it’s across the board.

Again, this isn’t news to anyone watching markets carefully. I present it to cut through the insanity surrounding Brexit and provide some context.

I’ve described Brexit as an existential threat to the EU. It is that and so much more. And it is why everyone on both sides of the channel are working so hard to undermine it.

In my latest for Strategic Culture I name names.

The EU does not want Brexit and if it were to happen it will inflict incredible damage to the British political system and its integrity.This is really no different than what happened in Greece in 2015. And it was directed by Angela Merkel than and it is being directed by Merkel today.The EU’s intransigence in negotiations, aside from it having no other option, is an elaborate bluff to separate and divide the British political class, now that the people have voted to leave.

I find it pathetic to see Merkel on a charm tour in Ireland this week to present her Mutti Merkel side to help ease the pain of Theresa May’s open betrayal of the British political system.

Germany’s descent into economic malaise now is Merkel’s biggest problem, though I doubt she’s fully cognizant of the implications. Everyone suffers from normalcy bias and for her the European project should be strong enough to weather any storm.

The conventional wisdom is keeping the U.K. in the EU as a tax cow is paramount to ensuring continued German dominance over the bloc. And, I agree that is the thinking in Brussels.

But, I’m coming to believe that the reality is different than the mindset of the perpetrators.

So, I make the counter-argument that, in fact, Germany and Merkel have already lost the war to hold the EU together, regardless of Brexit. Destroying the British political system will not make the Brits easier to control, but rather harder.

It will not scare the recalcitrants like Matteo Salvini of Italy and Marine Le Pen in France. It will enrage them.

A failure of Germany’s economy to hold the bloc together will ricochet back on Germany’s leadership of the EU very quickly. We’re seeing this in French President Emmanuel Macron’s open defiance of Germany on Brexit.

So many people, including Remainers in London, make the argument that they can’t survive against a bigger, stronger economy like the EU’s, namely Germany’s.

So much of what the EU is built on has been the willingness of everyone else to suffer Germany’s visions for integration as long as Germany was willing to fund it.

But, that’s looking more and more to not be the case into the future. The EU has nearly reached the limit of internal transfers which paper over how weak Germany’s long-term economic prospects are under the current political rubric.

There comes a point when a simple slide into recession is not just another cyclical downturn that can be papered over by more central bank credit and wizardry.

It becomes something the politicians can’t strong-arm away and the media can’t sugar-coat.

Germany’s recession is here because of the structural problems of the EU’s fiscal black hole. It’s resulting in obvious capital flight into U.S. assets — the dollar, stocks and bonds simultaneously.

It has pushed up the price of safe-haven assets in Europe beyond absurd levels. And yet, no one dare call this a crisis!

And because there is still some slack yet in the German economy, it hasn’t fully expressed itself yet at the consumer level. So, that gives everyone enough wiggle room to talk the talk. But, savings is rising rapidly while consumer spending is topping out.

The news is still mixed enough that it hasn’t begun to hurt Merkel further politically.

Just wait. It will be.

No comments:

Post a Comment