Rounding up the usual suspects won't restore a vibrant middle class.

What killed the middle class? The answer may well echo an Agatha Christie mystery: rather than there being one guilty party, it may be that each of the suspects participated in the demise of the middle class.

If you doubt the middle class has expired, please consider the evidence:

People tend to self-report viewing themselves as middle class, but by the standards of previous eras, they lack the basics of middle class prosperity. I laid out 12 core characteristics of classic middle class security in What Does It Take To Be Middle Class? (December 5, 2013)

By these standards, perhaps one-third of American households have the same security and assets as previous generations who identified themselves as middle class: Honey, I Shrunk the Middle Class: Perhaps 1/3 of Households Qualify (December 28, 2015).

The ten primary drivers of the erosion of the middle class are:

1. The shifting of pension and healthcare costs and risks from the state and employers to employees. (see chart below)

2. The decline of safe, secure high-yielding investments as central banks have driven savers into risky, crash-prone assets such as stocks and junk bonds.

3. The decline of scarcity value in college diplomas that were once the ticket to middle class security. How Many Slots Are Open in the Upper Middle Class? Not As Many As You Might Think (March 30, 2015).

4. The inexorable rise in big-ticket costs: higher education, healthcare and housing. Even as wages stagnate, these costs continue rising, claiming an ever-larger share of household incomes, leaving less to save/invest.

5. The transition from a stable economy with predictable returns to a financialized boom-and-bust economy that wipes out middle class wealth in the inevitable busts but does not rebuild it in the booms.

6. The regulatory and administrative barriers to self-employment, forcing most of the workforce into wage-slavery and/or dependence on the state. Endangered Species: The Self-Employed Middle Class (May 2015).

7. The rising exposure of the U.S. workforce to highly educated, lower-cost competing workforces in a globalized economy.

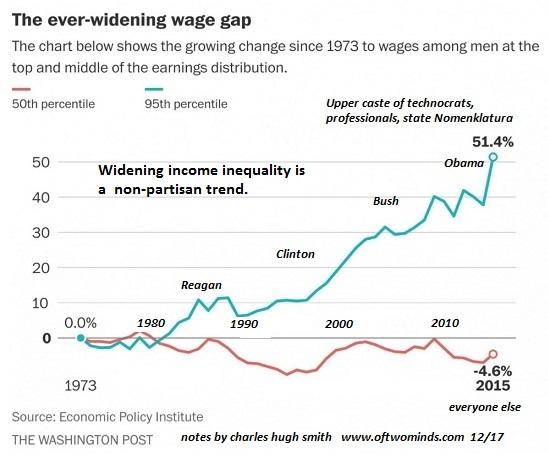

8. The decline of labor's share of the U.S. economy: the slice of the pie distributed to earned income is declining.

9. The share of the earned-income slice going to the top 5% is rising.

10. The wealth of the middle class is tied up in the family home, a non-income producing asset prone to the wild swings of housing bubbles and busts. Stagnation Nation: Middle Class Wealth Is Locked Up in Housing and Retirement Funds (October 25, 2017).

That's a lot of knives plunged into the middle class. Rounding up the usual suspects won't restore a vibrant middle class; that will require a systemic transformation of the U.S. economy and society from the ground up.

How would you describe the social mood of the nation and world?

Would anti-Establishment, anti-status quo, and anti-globalization be a good start? How about choking on fast-rising debt? Would stagnant growth, stagnant wages be a fair description? Or how about rising wealth/income inequality? Wouldn’t rising disunity and political polarization be accurate?

These are all characteristics of the long-wave social-economic cycle that is entering the disintegrative (winter) phase. Souring social mood, loss of purchasing power, stagnating wages, rising inequality, devaluing currencies, rising debt, political polarization and elite disunity are all manifestations of this phase.

There is a template for global instability, one that has been repeated throughout history…

Historian Peter Turchin explores the historical cycles of social disintegration and integration in his new book Ages of Discord.

Rising discord can be quantified in a Political Stress Index. Do we find evidence of Turchin’s disintegrative forces in the present era?

1. Stagnating real wages due to oversupply of labor: check.

2. Overproduction of parasitic Elites: check.

3. Deterioration in central state finances: check.

Is it any wonder that political stress, however you want to measure it, is rising?

Long periods of stable prices (supply increases along with demand) beget rising wages and widespread prosperity. Once population and financial demand outstrip supply of food and energy — a situation often triggered by a series of catastrophically poor harvests — then the stability decays into instability as shortages develop and prices spike.

These junctures of great poverty, insecurity and unrest set the stage for wars, revolutions and pandemics.

It is remarkable that the very conditions so troubling us now were also present in the price rises of the 13th, 16th and 18th centuries.

Unfortunately, those cycles did not have Disney endings: the turmoil of the 13th century brought war and a series of plagues which killed 40% of Europe’s population; the 16th century’s era of rising prices tilled fertile ground for war, and the 18th century’s violent revolutions and resultant wars can be traced directly to the unrest caused by spiking prices.

Based on the history painstakingly assembled by Fischer and Turchin we can thus anticipate:

— Ever higher prices for food, energy and water.

— Ever larger government deficits which end in bankruptcy/repudiation of debts/new issue of currency.

— Rising property/violent crime and illegitimacy.

— Rising interest rates (until very recently this was considered “impossible”).

— Rising income inequality in favor of capital over labor.

— Continued debasement of the currency.

— Rising volatility of prices.

— Rising political unrest and turmoil (see “Revolution”).

And there you have our future, visible in the 13th, 16th and 18th century price-revolution waves which preceded ours.

With this list of manifestations in hand, we can practically write the headlines for 2019-2025 in advance.

No comments:

Post a Comment